Job Description

The financial and support director is responsible for overseeing and managing the financial resources of the neo-bank, ensuring effective financial planning, reporting, and control. This role involves managing the organization's financial health by supervising budgeting, cash flow, accounting, and capital management while also supporting supplier relationships and asset protection. The primary objective of this role is to ensure the organization's financial sustainability and support strategic decision-making by providing timely and accurate financial insights.

Financial Management:

- Supervise the organization’s financial activities, including budgeting, financial analysis, and control of costs and revenues.

- Ensure effective management of financial resources to maintain the financial health of the neo-bank.

- Develop and monitor the financial strategy in line with organizational goals, ensuring sustainable growth.

Financial Reporting:

- Prepare accurate and timely financial reports, including income statements, balance sheets, and cash flow statements.

- Provide financial insights and reporting to senior management and shareholders to support strategic decision-making.

- Ensure compliance with all financial regulations and accounting standards.

Accounting Management:

- Oversee the accounting department, ensuring precise recording and tracking of all financial transactions.

- Manage accounts payable and receivable, ensuring timely payments and collections.

- Supervise the reconciliation of accounts and ensure accurate financial record-keeping.

Liquidity and Capital Management:

- Manage the organization’s liquidity to ensure sufficient cash flow for operational and strategic needs.

- Oversee capital management to ensure efficient allocation of financial resources and investments.

- Provide strategic guidance on capital structure and financing options for future growth.

Financing:

- Lead efforts to secure funding for the organization, including managing relationships with investors, creditors, and financial institutions.

- Develop strategies for capital raising and financing to support both short-term and long-term goals.

- Analyze funding requirements and ensure optimal financing solutions are in place.

Supplier Relationship Management:

- Oversee relationships with suppliers, ensuring that contracts are well-managed, and goods/services are delivered on time and at the expected quality.

- Collaborate with the procurement team to optimize supplier contracts and ensure cost-effectiveness.

Asset Protection:

- Ensure the protection of the organization’s assets, including financial and physical resources.

- Implement policies and controls to safeguard the organization’s resources and prevent losses.

- Regularly review asset management strategies to ensure responsible and efficient use.

Requirements:

- Bachelor's degree in related fields such as Finance, Accounting, Business Administration, or similar disciplines.

- 10 years of proven work experience in financial management, preferably in the banking or financial technology (FinTech) industry.

- Relevant professional certifications such as CFA, CPA, or ACCA.

- Comprehensive knowledge of accounting principles, financial regulations, and corporate financial management.

- Successful track record in managing Profit & Loss (P&L), financial forecasting, and budgeting.

- Proficiency in MS Office programs.

- Fluency in English.

Employment Type

- Full Time

Job Category

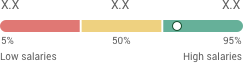

Seniority

Details

Employment type

- Full Time

Job Category

Seniority