Job

Company

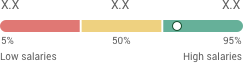

Salary

Applicant Insights

Job Description

Mission:

- To manage all aspects of the payroll function, ensuring compliance with latest relevant legislation, statutory filing deadlines and internal management reporting requirements to ensure smooth operation of MTNIrancell payroll processes

- To manage and maintain high levels of quality and service, ensuring prompt and accurate processing, payment, reporting and record-keeping of payroll

- To lead and manage all activities involved in processing, preparing and disbursement of MTNIrancell payroll for all nationals, expatriates and contractors

Responsibilities:

- To liaise with Finance Budget team and HR remuneration on staff cost planning

- To collaborate with Finance ERP team on preparation and distribution of pay slips

- To support all internal and external audits (i.e. statutory audit processes) related to payroll and respond to payroll-related queries raised by tax authorities or other regulatory bodies

- To ensure payroll is processed in an accurate, compliant and timely manner

- To oversee preparation of payroll account reconciliations and ensure resolving payroll discrepancies

- To verify accuracy of data extracted from HR systems and imported into payroll system with minimal errors

- To determine payroll liabilities by approving the calculation of employee income and social security taxes, employer’s social security, unemployment, advances, loans and other compensation payments in strict compliance with statutory requirements and MTNIrancell policies

- To provide information and advice on payroll-related matters, responding to staff queries and liaising with departmental managers, staff, HR, Finance and related teams as necessary to ensure resolving claims and/or legal disputes

- To continually review existing processes and systems, with a view to innovate new practices, develop new or improved procedures and recommend and implement changes leading to best practice operations

- To set up, update and manage efficient work systems and effective internal controls within payroll function, ensuring that processing errors are minimized and changes are reflected accurately and promptly

- To review existing payroll and payable tax procedures, in collaboration with HR and Finance where appropriate, making practical and value-added recommendations

- To interpret new legislations impacting payroll and ensuring related employee data systems are updated accordingly

- To ensure all payroll information and records are maintained accurately and in accordance with statutory requirements

- To oversee the preparation of weekly, monthly, quarterly and year-end reports in addition to year-end tax forms for staff

- To approve payroll cheque as required and ensure transfers to banks are made within specified time frame

- To collaborate with Finance internal teams on the various staff payments and provide related reports.

- To ensure that accurate budget is accounted in accrual accounts for each staff remained leave

- To build effective networks and good relationships with colleagues and stakeholders while maintaining confidentiality and always showing tact, sensitivity and support

- To ensure confidentiality standards are being met during the payroll management process and perform due diligence to ensure that employees are paid timely and accurately.

Requirements

- Bachelor’s degree in Financial Management, Accounting, or a related discipline.

- At least 5 years of experience in an area of specialization; with experience in supervising/managing others.

- Experience working in a medium to large organization.

Technical Competencies:

- People Management;

- Supplier Relation Management;

- Accounting Principles;

- Financial Analysis;

- Reconciliation;

- Financial Reporting;

- Local Accounting Standards;

- International Accounting Standards;

- Labor Law;

- Local Payment Operation;

- SSO Law;

- Trend Analysis;

Behavioral Competencies:

- Leadership;

- Innovation;

- Relationship;

- Integrity;

- Can-do;

- Customer Centricity;

- Agility;

Employment type

- Full Time

Job Category

Seniority

To see more jobs that fit your career

To see more jobs that fit your career

© 2025 IranTalent.com All rights reserved. Terms and Conditions Privacy policy